I came into town on a highway from Atlanta, the shining symbol of a young and prosperous and growing New South. It was February 2013 and I was making the first of several trips to Albany, Georgia, in the southwestern part of the state, sixty miles from the Alabama border. Jimmy Carter’s evangelism took root here. It is the home Ray Charles evokes when he says Georgia’s on his mind. Stately antebellum plantations line the highway into town, rare historic gems that still stand because this area avoided direct fire during the Civil War.

Today, millionaires and billionaires host lavish retreats in the mansions and hunt quail on the former farmland that surrounds them. The celebrity chef Paula Deen is one of Albany’s most famous daughters; when she got herself into trouble waxing nostalgic about plantation-style dinners with black servants, she was probably talking about her experiences in these houses. To be fair, jobs on the plantations are coveted by some of Albany’s black residents. Ask around and some people will tell you that they pay better than most other businesses in the area.

As the Great Recession came to a close, the roll call of the nation’s poorest cities was topped by familiar Rust Belt names — Reading, Pennsylvania; Flint, Michigan; Bloomington, Indiana. Most of these cities had been intensely poor for decades, but Albany, which tied Bloomington for third place on the list in 2010, was different. Its collapse was recent — and fast. Between 2007 and 2010, Albany’s poverty rate jumped 12 points, to a record high of 39.9 percent. More than two thirds of Albany’s 76,000 residents are black, and since 2010, their poverty rate has climbed even higher, to nearly 42 percent.

Albany is, of course, only a more extreme example of something that’s happening across the country. Not counting the elderly, among whom Social Security has driven a sharp and lasting decline in poverty, a greater share of Americans are poor today than at any time since the 1960s. In the United States in 2013, 45.3 million people lived below the official poverty line, with incomes of less than $12,000 a year for a two-adult, two-child family.* A third of them were children. Twenty million people live in what economists call deep poverty, with incomes of less than half the official poverty line. That’s almost three times the number of people who lived in deep poverty in 1976.

Historically, the poverty rate has tracked the overall economy, but that’s no longer true. The period between the 2001 and 2007 recessions was the first expansionary business cycle on record in which the poverty rate increased, according to an Economic Policy Institute analysis of Census Bureau data. It’s also the first expansionary cycle on record during which incomes in the middle quintile fell. A return to the prerecession economy won’t alter the trend because, as Albany’s story shows, the problems began with the boom, not the bust.

Even if the economy continues to grow, the effects of the past decade will linger. “While the poverty rate changes, the rate of escaping from poverty doesn’t,” says Austin Nichols, formerly a labor economist at the Urban Institute. “When you have a shock of poverty, because of recessions, say, and poverty goes up, it has a very long-term impact.” Absent a significant intervention, the 14.7 million kids who live in poverty today are extremely likely to become poor adults.

Albany was established on the banks of the Flint River in 1836. It was named after Albany, New York, in hopes that it would become a similar center of trade for the South. Today, if you linger on the west and north sides of town, where the city’s predominantly white middle class is concentrated, Albany seems like any other midsize American city. There are strip malls and office workers and tidy, modest homes.

But if you scratch the surface of even the relatively well-off areas, you begin to see how a town in which four out of ten people are poor can collapse in on itself. It’s a process defined not by big, dramatic moments of pain but by a quiet, steady throb — a pain you can manage, until you can’t. It manifests in people like Floyd Faulk, a white, fifty-two-year-old lifelong resident who’s gone from operating a thriving drapery-design business to clambering around rooftops to install satellite dishes. He keeps the design business open only to stave off formal bankruptcy.

Downtown, near an eighty-five-year-old railway bridge that spans the river, there’s a small park with live oaks covered in Spanish moss. On Broad Avenue, one of the city’s main thoroughfares, the shops stand empty, their windows bearing seemingly permanent for rent signs. The few tenants that remain are bottom-feeding ventures such as personal-finance shops and rapid-refund outfits. LaNicia Hart’s storefront is one of the exceptions: the display window is filled with meticulously arranged sportswear decked out with fraternity symbols. Hart, who grew up in Albany, is a young entrepreneur who in many ways embodies the New South, in which a black middle class is said to thrive. She returned to her hometown after college to open an embroidery business. But even her store offers evidence of Albany’s weak economy: most days, she keeps the front door locked while she fulfills online orders in the back.

Faulk and Hart represent the 60 percent of Albany residents, black and white, who are keeping themselves above the poverty line. They are notable for having remained despite possessing the resources to leave. If there’s one simple explanation for the area’s spike in poverty, it’s that when thousands of jobs left, the middle-class workers who once held them left, too, creating a more densely poor city. “We had a functioning school, we really did,” said Cindy Towns, who teaches civics at Dougherty Comprehensive High School and sent her three daughters there. “But families started moving, looking for opportunity elsewhere. And those families that left and moved were the ones who were more involved. They were the ones who could move.”

We were sitting in the classroom of Ashley Mitchell, one of Towns’s colleagues, at the end of a long school day. Mitchell, who graduated from Dougherty High herself, ticked off the challenges that have accompanied the city’s increasing poverty. “Low test scores, lack of literacy, a lot more children being diagnosed with ADHD, learning disabilities. The school pride, the school culture goes down. Nobody wants to send their kids to school where the school is struggling. So when we lost that pool of kids” — she finally took a breath — “it really affected the school.”

It’s well known to Albany’s black residents that whites are fleeing to neighboring Lee County, taking tax dollars with them. The county’s name is often invoked as a slur: Well, she lives out in Lee County now, you know. People in Albany accuse white real-estate brokers of steering buyers away from the city. On one of my earliest visits to Albany, I sat in on a meeting of the Economic Development Commission that addressed race relations in town. During the discussion, an officer at the Marine Corps logistics base, the largest employer in town, described the challenges that mixed-race couples on his base have had in Albany. Integrated relationships are “just not normal here,” he said, twisting his face in frustration.

Near Dougherty High, at a food bank in a mostly black area on the east side of town, I met Juanita Nixon, who works for her church’s family-resource center, which provides emergency meals to the poor. When I asked her what Albany’s recession had meant for the people she served, she echoed an answer I heard all over the city: they’ve lost hope. She turned to Eliza McCall, the food bank’s spokesperson, and joked, “If you put hope on the inventory, I’d order it all.”

McCall estimated that the food bank would have to give out more than 11 million pounds of food this year to get just one meal a day to every person in the county who is in crisis. The bank can meet only a third of that demand. Nixon has worked for her church for twenty-five years but has never seen anything like the situation today. “When I leave here,” she said, waving toward the loading dock, “I’ll come in contact with six or seven families that need help.”

I met Major Jones in a Red Lobster parking lot just outside downtown. He couldn’t make it from his truck to the restaurant without stopping to shake hands with neighbors, church members, and former co-workers. Albany is a close-knit community, and Jones has been here a long time. His short fade is flecked with gray, but he’s boyish in appearance and demeanor; his devout Christianity doesn’t stop him from enjoying a bawdy joke in relaxed company.

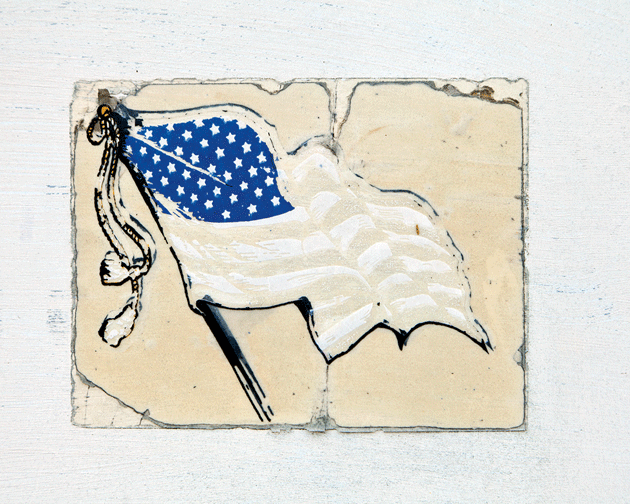

Left: Floor of the former Bobs Candies factory, which closed in 2005. Right: Entrance to the Bobs Candies factory

Jones grew up sixty miles away, in Fort Gaines, Georgia, and moved to Albany in 1978. “Right out of high school,” he recalled. “There was a lot of work here. Firestone was here. Textile was here. Miller Brewing was coming here. You had Procter and Gamble. You had Georgia-Pacific.”

Shortly after arriving in Albany, he went to work at the Bobs Candies factory, where he stayed for more than twenty-five years. “I never got laid off from there, and I liked that. It wasn’t a lot of money. I was just old-fashioned and dedicated to what I was doing,” he said. He started at $5.45 an hour and worked his way up to $19, with health insurance, retirement, and, most important, guaranteed work. “We worked a lot of overtime, so I got the hours. And that was great.”

As Albany’s manufacturing sector developed in the 1920s, many plants settled in poor, black neighborhoods, but they gave their best jobs to white residents. Bobs Candies was notable for hiring black workers who lived in the neighborhood.

Bob McCormack founded the company in 1919. It was run by three generations of McCormacks and weathered the Depression, the sugar rationing that accompanied World War II, and a tornado that flattened its facilities. In 1950, Gregory Harding Keller, Bob McCormack’s brother-in-law, invented a machine to twist soft candy into spiral stripes, which allowed the mass production of candy canes for the first time. “We were the largest peppermint-candy maker in the world,” Jones bragged.

“We had a wonderful workforce, and it was predominantly African Americans,” said Greg McCormack, who was the last in his family to run the business. “As many African Americans went into the workforce, there was a lot of discrimination, and Bobs was one of the only places that paid the same for blacks and whites.” It was an attractive place for black workers trying to get in on the midcentury economic boom, and its reputation still held when Jones came looking for work.

“Major would be a great example, I think, of someone that might not have been employable today in most industries,” McCormack said. “He was young, and I think one of the hardest things when you’re young is just to get work. And you learned job skills at Bobs that would help you later on. Major really embraced that.” Jones said that he twice turned down promotions to supervisor at Bobs — “You’ve got to constantly mentor people,” he explained — before finally accepting the position for the night shift. He prospered.

Candymakers have long fought Congress over sugar prices, which they say are inflated because of U.S. sugar policy. Sugar producers, of course, argue that the candymakers are crying wolf in order to gain access to subsidized Brazilian and Chinese sugar. Whatever the cause, candymakers have spent decades watching their supply costs gain ground on their revenues. To compensate, they’ve begun taking advantage of free-trade agreements such as NAFTA. In 2001, Bobs opened a plant in Reynosa, a Mexican border town. For McCormack, that was the beginning of the end. “There’s not a single red-and-white candy cane packed in a twelve-cane box made in the United States anymore,” he complained. “And it’s a shame. And part of the issue we had in the family is, I just didn’t want to do that.”

McCormack still complains about sugar prices, but he also criticizes the company’s largest customer: Walmart. For candymakers, sugar prices are so critical because doing business with Walmart demands cutting costs to the bone. Suppliers compete fiercely to remain in the retail behemoth’s favor. “You wake up one day and you lose thirty percent of your business because you didn’t your cut your price by a penny,” McCormack said.

At Bobs, these pressures led to unprecedented rounds of layoffs. Jones was surprised when they kept him on as a supervisor even as people with college degrees were laid off. “I remember that day like it was yesterday,” he said, his voice catching.

In 2005, the McCormacks sold Bobs to Catterton, a private-equity firm in Greenwich, Connecticut, that manages more than $4 billion. It’s a midsize player in the overall market, but it’s one of the largest private-equity firms that focuses on the consumer sector. In 2002, Catterton began buying up candymakers. It acquired several flagging divisions from Kraft Foods and pulled them together under the umbrella of Farley’s and Sathers Candy Company. It grabbed Jujyfruits and Chuckles from Hershey’s. Later it bought Brach’s Confections. In 2012, it merged these companies with Ferrara Pan, which makes Red Hots and Lemonheads, to create the third-largest candymaker in the country, with annual sales of $1 billion. Catterton continues to hold a majority stake.

Catterton closed Bobs Albany plant within months of buying the company. “I think they gave the workers thirty days’ notice or something,” Jones said. Nobody saw it coming. “You’re just thinking, That won’t happen with this company.” Even with his severance — a relatively generous year’s pay — and the savings he’d managed over twenty-five years, Jones still needed to cut lawns to make ends meet. He wasn’t officially poor. He had his savings, and his wife, Vieliene, had a teaching job. But their years of economic security were over.

On a Wednesday night in the middle of a hot summer, I went to a midweek open-mic show at the Oglethorpe Lounge in downtown Albany to learn about what most consider to have been the city’s economic deathblow — the closing of Cooper Tire and Rubber. When Bobs closed, the city lost about 280 jobs. But Cooper employed five times that many people — and still more if you count its part-time workers.

When I arrived at the Oglethorpe, the night was just getting started and Chuck Jenkins was fussing with the sound system. He and a handful of others had dreamed up the weekly event as part of their effort to save the Oglethorpe, which has been around since the Fifties, from Albany’s crashing economy. Jenkins had donated a garageful of sound equipment that he’d amassed while working at Cooper. A hulking sixty-year-old harmonica player who looked like a cross between a middle-aged hippie and a member of ZZ Top, he was quick to admit that he was still an amateur when it came to music. “I can’t play but so long, or it’ll be repetitive,” he confessed. His bandmates were former co-workers. Tonight, they would join the show to cover everything from James Brown to AC/DC.

The Oglethorpe’s regular crowd is mostly white, but it’s one of the few social spaces in Albany that is truly integrated. “I had a guy my age out at Cooper, and when we started our band, he asked me if black people could come to the restaurant where we played,” Jenkins recalled. He laughed and shook his head. “This was 2005!” Jenkins had been in Albany since 1970. He said he’d seen a lot of changes, but few as dramatic as Cooper’s shutdown.

Jenkins was hired at Cooper in 1992, and was among the first to work at the Albany facility — his time card was number 306. He stayed there until the plant closed, in 2009. He had been out of work ever since, spending down his pension and exhausting his unemployment benefits while taking classes and sending job applications into the void. “There is a depression that comes with that,” he acknowledged quietly.

Jenkins started at Cooper as a machinist, spinning wire into rubber casings. “Then I went over to tire assembly, where we actually assembled the basic carcass of the tire,” he explained. “I did that for eight and a half years, and then I became a material handler.” He hauled giant coils around the plant to keep the various units humming. By the time of the shutdown, he’d graduated to a team that tested new production techniques. As at Bobs, no one at Cooper believed the end was coming until it arrived.

Plenty of U.S. tire factories had closed during the preceding years — many at the peak of the business cycle. This was another new and odd economic trend of the 2000s. After China was admitted to the World Trade Organization, in 2001, cheaply made Chinese tires flooded the U.S. market, and U.S. tire jobs went to China.

Cooper was one of several U.S. tire makers that opened plants in China during the 2000s; the company even sent workers from Albany to train their Chinese counterparts. Jenkins remembered that moment proudly. The Albany plant required a skilled workforce to make giant, complicated tires for trucks — the smallest production error could be disastrous. “We were told this is probably the most modern of the tire plants, the most room to grow,” Jenkins said. “We were led to believe that they would not have spent all this money here to develop this if they were going to . . . ” He trailed off.

One week before Christmas in 2008, Cooper announced that it was closing the Albany operation. The company had determined that its expanding operations in China meant that one of its U.S. plants had to go. Management conducted an internal audit to pick the loser, setting off a frenzied competition. Two of the four plants were unionized, and the labor force made huge concessions to the company, including wage freezes. Albany’s workers, who were not unionized, could offer nothing comprehensive.

Cooper’s shift to China has been enormously lucrative for the company. In 2013, annual profits were $241 million. The CEO, Roy Armes, who joined Cooper in 2007, made $9 million last year. Trade agreements like the Trans-Pacific Partnership, which the Obama Administration was trying to push through Congress this summer, could make it even easier for Armes to move more of Cooper’s operations to Asia.

Jenkins said that during his seventeen years at Cooper, he topped out at around $56,000 a year, plus benefits that included the pension he had just about burned through after four years of unemployment. Like so many others, he got caught between the simultaneous crises in the housing and job markets. Rather than lose the house that he had bought after starting at Cooper, he escaped foreclosure by sacrificing more than a third of his pension to pay off his mortgage. He figured that he’d at least avoid homelessness.

Recessions always create a trailing effect in which joblessness and poverty extend past the worst part of a downturn. But the most recent recession has had a tail like no other. As of May 2015, nearly 30 percent of the nation’s unemployed had been out of work for at least six months.

“Part of it is there’s this change in the social contract — employers behave differently now,” says Austin Nichols. During previous recessions, large employers tended to behave like the McCormacks: they were slow to lay off workers because the cost of hiring and training was so high. It was better to weather the downturns and capitalize on the recoveries. Productivity used to drop during recessions, as companies temporarily employed more workers than needed. But according to Nichols, “That wasn’t the case in the Great Recession; productivity actually rose. . . . What that indicates to me is, employers were letting go of more people than they had to. They were actually aggravating the problem.”

When I returned to the Oglethorpe a few months after I first met Jenkins, he wasn’t there. Friends said they hadn’t seen him in weeks, not since he’d taken a seasonal job working on the pecan harvest. At sixty, he had begun a new career as a farmhand.

This weekend, I was cutting grass and I said, ‘Lord, I just need you to keep me busy today.’ Two different people called me!” Major Jones was testifying in front of his Sunday-school class, part of a small congregation he and Vieliene founded in 2012. “All day Friday, I worked,” he said, building volume and fervor as he recalled the weekend’s rare good fortune. “Came yesterday, I said, ‘Lord, I need some more work.’ Another guy called me, said, ‘Man, you can do the yard on Monday.’ ” It was an outpouring of opportunity right when he needed it, and to Jones, it was divinely inspired. “You have naught but His favor!”

“Amen, you got to believe,” Vieliene said. “We’re walking in favor!”

Our Bibles were open to Genesis, Chapter 15, in which Abram is having trouble trusting in the Lord. He has grown restless waiting for God to fulfill His promise that Abram would become the father of a great nation, and he wants to know how he can be sure it will come to pass. God offers reassurance, but reveals that Abram’s people will endure 400 years of slavery and hardship. The people must hold on and bear up under their ordeals; only then will they be delivered to the promised land. This is familiar scripture for black Americans, certainly in the South. But for the Joneses, the teaching felt fresh and urgent. “God is working on my behalf!” Jones declared triumphantly at the end of his testimony.

Organized religion is just about the only industry still growing in Albany, a fact that inspires cynicism in some. Even the Joneses look warily at Albany’s proliferating houses of worship. But, Vieliene told me, “people need hope.” Their church is the House of Hope Fellowship Church, and their services are relentlessly positive. God’s favor is celebrated with equal intensity for an out-of-work member who avoided eviction and for another who got a $25 late fee waived at Sam’s Club. As Vieliene put it, “We already know the devil is busy, why lift him up?”

In 2006, Jones was hired by a temp agency with a contract on the Marine Corps base. The catch was that his job would last only two years, until the end of his employer’s contract. Since 2008, he’s surfed from contractor to contractor, managing to stay in the workforce for two years at a time. “After people on the civil side kind of like you and they know you, they’ll recommend for you to be picked back up,” he said. “Ain’t nothing guaranteed with that.”

The government doesn’t collect comprehensive data on how many public-sector jobs have been privatized in recent years, but an approximate measure of the change is the amount of money it spends annually on contractors; in 2012, that figure was $517 billion, an increase of 150 percent from 2000, according to a recent National Employment Law Project analysis of federal data.

Jones said that he earned just a little less than his civil-service co-workers on the base, but he was not compensated for sick days, and his contract could be terminated at any time. That instability became clear to him in 2013, when across-the-board federal budget cuts, the so-called sequester, forced furlough days at the base. He lost a lot of hours, time he could scarcely afford. As it was, he was making the same wages — roughly $19 an hour — that he had earned ten years earlier at Bobs. This kind of wage stagnation is widespread today, and it puts Jones and millions like him just one crisis away from insolvency.

In the absence of a federal solution to these problems, some have argued for a fundamental change in how we build local economies. Shirley Sherrod, formerly the Department of Agriculture’s director of rural development in Georgia, is perhaps most famous for having been caught in the crossfire between the Tea Party and the White House. In 2010, the Obama Administration pressured her to resign after Andrew Breitbart publicized a heavily edited video in which Sherrod appeared to confess that she had denied federal aid to a white farmer. The full video revealed that precisely the opposite had happened.

Long before Sherrod became cable-news fodder, however, she and her husband, Charles, were household names in southwest Georgia. Charles was among the first SNCC organizers to come to the region; there’s a park dedicated to him in downtown Albany. Shirley grew up in Baker County, one of Albany’s rural satellite communities, and has been one of the region’s most dedicated poverty fighters.

I visited Shirley Sherrod at a plantation that her agricultural-development organization, New Communities, bought in 2011. The facility, which is used for research and training, seemed to exist in a different universe than the plantation as imagined by Paula Deen. Using the collective action of the sharecroppers of her grandparents’ generation as a model, Sherrod was teaching new farming methods and giving civil-rights workshops. “I can point from one community to another here in this county where people actually worked, together, to acquire land and do things in their community,” she said.

The plantation is one of several loosely connected efforts that Sherrod oversees. Others include an old schoolhouse that’s been remodeled as a USDA-certified commercial kitchen and an ongoing campaign to create a central processing center for local farmers. These efforts feel like drops in an ocean of need, but Sherrod argued that town by town, such projects can make a difference. “It could be a whole lot more, but what if it wasn’t anything?”

Barack Obama was supposed to bring more options to places like Albany. As a candidate in 2008 and 2012, he campaigned against the currents that have concentrated wealth and intensified poverty in America. He said he was going to freeze foreclosures and demand that banks release job-creating capital for small businesses. He was going to invest in infrastructure to replace jobs lost to offshoring and the operational efficiencies of private equity. Some of these things have happened, but most have not. If the Trans-Pacific Partnership treaty passes, the offshoring, at least, will get worse. Meanwhile, House Republicans have led a campaign to blame poverty on the few, essential programs that hold it at bay for millions of families.

Given this political climate, Sherrod’s brand of hyperlocal, worker-by-worker economic development has the advantage of at least acknowledging the crisis. There’s not much time left for the federal government to similarly come to terms with reality.

In the meantime, Albany waits for a change. I once asked Major Jones if he thought his city was already beyond salvation. He answered carefully; his faith does not allow for total despair. “Death lies in the power of your tongue,” he warned. “But sometimes, it’s gotta get worse before it gets better.”