Wall Street Places Its Election Bets

How do the two presidential candidates stack up in the eyes of America's investment class?

Has Wall Street made up its mind on this election? One analyst, Jeffrey Kleintop, has divined just who the investment class believes will be president by developing one of those magic election-year metrics. (Double the price of a bag of groceries in St. Louis, divide by each candidate’s favorability rating in the Rust Belt, and voilà—the winner!) Kleintop’s Wall Street Election Year Index (.pdf) looks at specific stocks that are enjoying an uptick. The theory goes that a certain basket of stocks traditionally does better under Democratic presidents and a different basket does better under Republican presidents. Check to see which basket is doing better in the run-up to the election, and you know who Wall Street thinks will win.

This year’s mix is revealing. Kleintop believes a good hedge fund, confident in a win for Mitt Romney, would move its portfolios toward major segments of the energy sector. Conversely, since an unrepealed Affordable Care Act promises to bring in millions of new customers to the health care industry, one might expect a rise in stocks specializing in “health care facilities” and “health care services” in anticipation of an Obama win.

Kleintop says he not only looks at the top stocks, but also employs an algorithm that will “strip out and balance out the cyclicality,” as he told CNBC’s Jeff Macke earlier this summer. Checking the top five or ten health care and energy stocks on an anecdotal basis (and thus surrendering to the evils of cyclicality) reveals no demonstrable prediction from Wall Street. But according to Kleintop’s algorithm, another class of investments is also set to grow if Obama wins reelection—the one that encompasses “construction materials,” “homebuilding,” and “construction and farm machinery.” And here, the big portfolio managers seem to have shaken their Magic 8 balls and come up “Obama.”

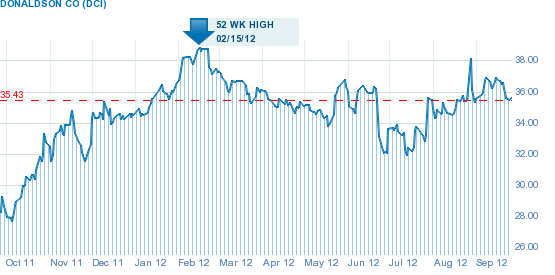

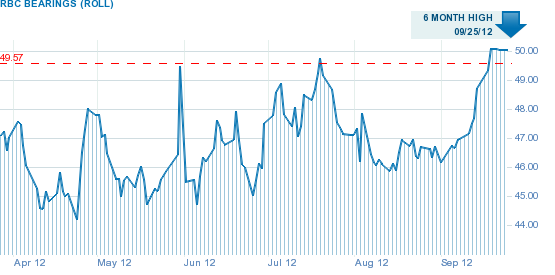

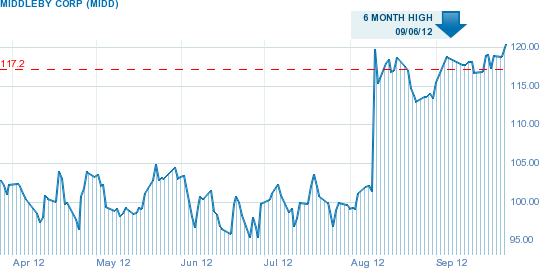

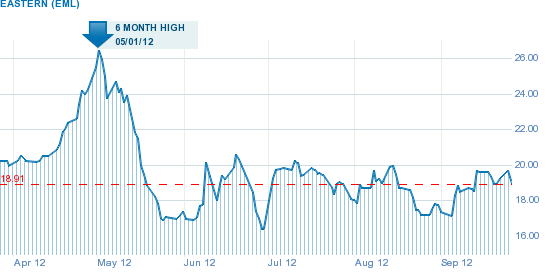

I googled the top stocks in the category of construction materials, and what I saw was fascinating. Not only does Wall Street seem to be betting its portfolios on Obama, it would appear that its collective realization occurred during the ramp-up to the conventions, sometime in July. At that time, Wall Street started to see a rosy future in the construction sector—a view that seems to be prevailing, with the top stocks there surging from 20 to 50 percent a few weeks ago. Below are charts showing trends for the top ten construction-materials stocks. The jump is unmistakable—you don’t find a loser until you get to the tenth, Clarcor.

In Connecticut, where I live, there’s no hiding the fact that while the state at large might prefer Obama, the money—i.e., Fairfield County: Greenwich, Stamford, Cos Cob, suburban Bridgeport—has abandoned him this time around. In 2008, in the part of Bridgeport where the big funders live, Obama raised nearly $4.5 million, compared with $2.8 million for John McCain. This time, Obama has come away with just over $1 million, while Romney has gathered about $4 million.

A friend of mine recounted for me a luncheon for equity-fund managers a few days ago in New York, at which the host asked some 500 of Wall Street’s finest to use a private voting device to answer a few questions. “The MC asked us to vote on who we WANT to win the election,” my friend wrote. “53% of the room said they wanted Romney to win. Obama got 47%.”

Perhaps that vote by itself is news—47 percent of equity-fund managers prefer Obama? But then the MC asked who they thought would actually win. “Over 70% said Obama would,” said my friend.

So, while the leaders of our financial sector are betting their personal funds on Romney, they’re betting their portfolios on Obama. I guess they don’t call it hedging for nothing.