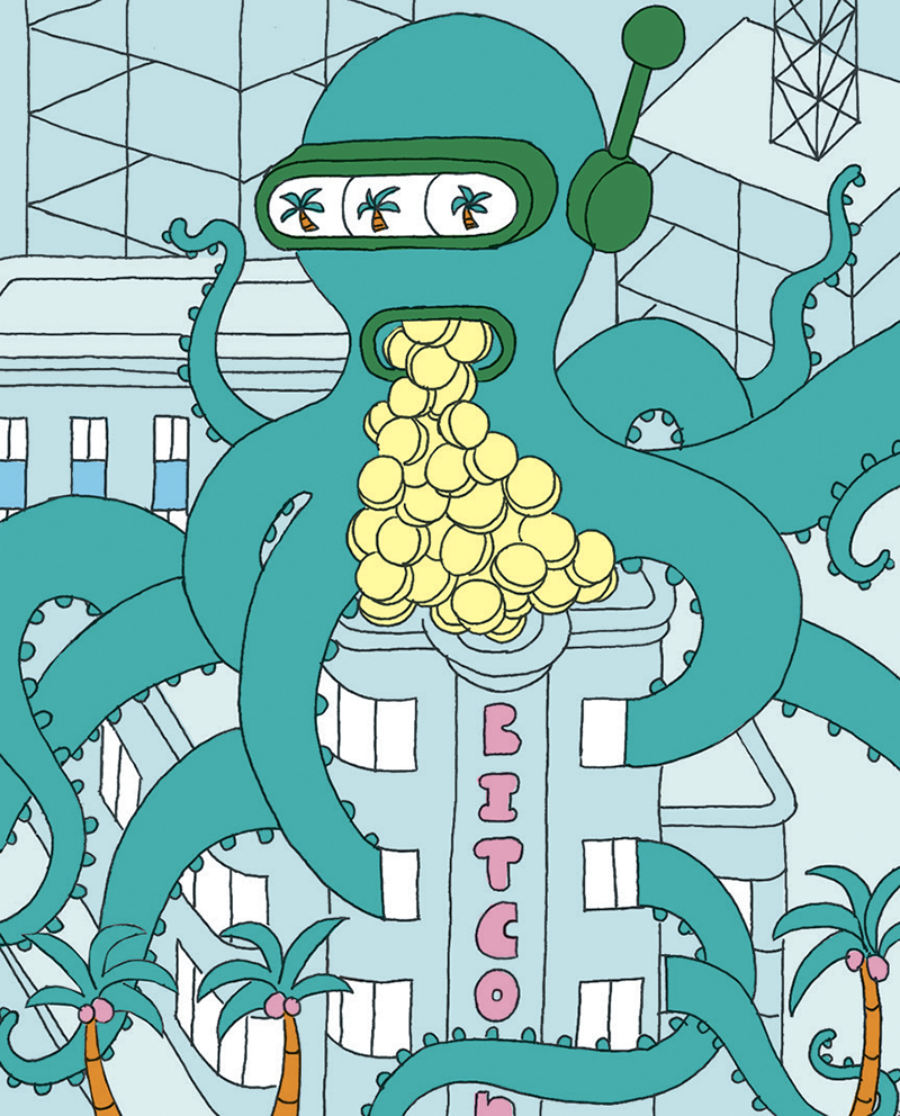

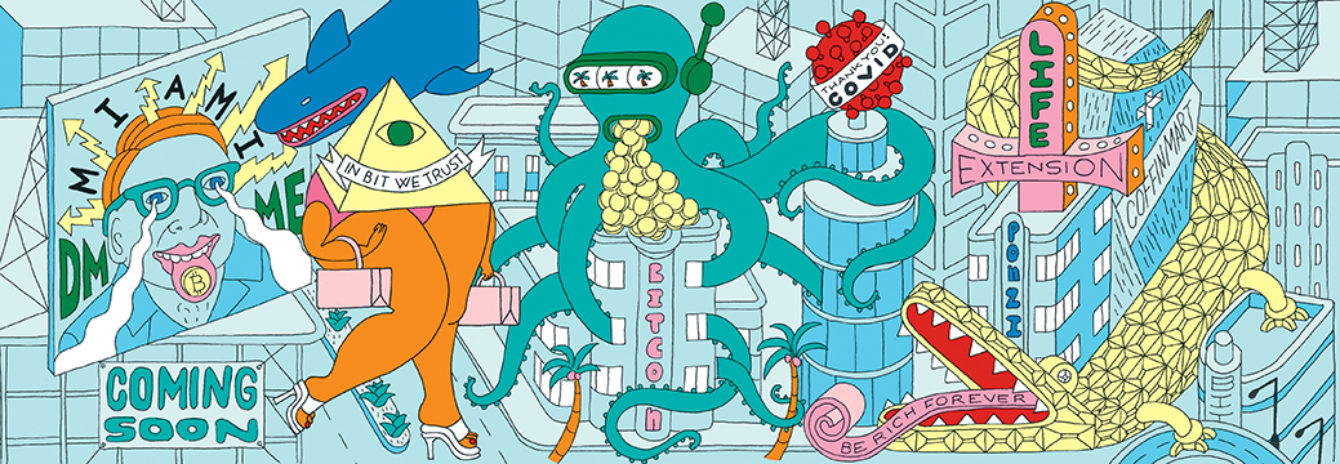

Illustrations by Melinda Beck

In the early days of the pandemic, I turned thirty and it occurred to me that I didn’t have a retirement account. I had never put any serious thought into investing, or had any real money to invest. I was financially illiterate—I had gotten my first credit card only a year earlier to pay for a flight to a friend’s wedding. I didn’t really own anything, beyond the clothes and books I dragged from one apartment to the next. I had begun to feel pathetic, with no prospects for accruing the kind of wealth that would allow someone to one day buy a house or start a family. What little money I had managed to save sat languishing in a savings account, where it earned an annual percentage yield so incremental as to be essentially negligible. Investments are, in some sense, an expression of our ideas about or confidence in the future, and I had always lacked much in the way of either.

My father, who considers himself an eminently reasonable fiscal conservative, recommended putting my savings into index or mutual funds. This seemed rational, if unexciting. I envisioned myself at around age seventy, presuming I lived that long, finally cashing in on my intelligent investments and blowing it all on some desultory Caribbean cruise. But I wasn’t sure I could put a child—a child I don’t have, to be clear—through school with mutual funds. And anyway, something strange had started to happen. All around me, I seemed to be just one or two degrees removed from people who had, in the past few months or years, made a quick and startling amount of money through a very different sort of investing.

A weird form of speculative fervor had gripped my generation, even those of us who had always ignored or resented the idea of “the market.” Thanks to new, consumer-friendly apps like Robinhood and Coinbase, and investment advice from Reddit, Twitter, and early-adopter friends, small fortunes were being made, sometimes in a matter of days. The market seemed increasingly decoupled from any sense of reason. There were the absurdist explosions in the stock prices of GameStop and AMC, businesses previously viewed as moribund, and then there was the still-burgeoning ecosystem of cryptocurrency, with the stalwart Bitcoin at its center, which appeared to operate with a similar kind of bullish illogic. It didn’t matter whether these were sound investments in the old sense of the term, whether the technical fundamentals were highly sophisticated or nonexistent. What mattered—or so it appeared from the outside—was whether large enough communities of retail investors had swarmed around them and decided that it was to their collective advantage to pump prices as high as they could go.

I raised the subject of cryptocurrency with my father, who admitted he didn’t understand it. (He’s not alone: more than 60 percent of those familiar with the concept admit to having little to no sense of what it means.) He cited a rule he’d picked up from reading Peter Lynch, a once-legendary Fidelity mutual-fund investor: Never invest in something you don’t understand. It seemed like sensible advice. The sort of advice my father and Peter Lynch and many others in their respective generational cohorts had used to construct relatively functional lives. I ignored it. I put some money into index funds, sure, but I also bought into crypto, reasoning that Bitcoin’s price alone had shot up from the low four figures in early 2020 to over $60,000 the following April. Proponents seemed convinced it could hit $100,000 by December. I realized that if I had spent my first stimulus check on Bitcoin, it would have already been worth well over ten grand—after a single year. Surely I would soon be a wealthy man. Was the price even capable of going down?

It was. And it did. It fell, and fell almost immediately after I’d bought my way in that May. I’d “bought the top,” in investment terms. By the logic of the Greater Fool Theory of market behavior, I was the Greater Fool. All I had wanted was a get-rich-quick scheme that actually worked, which was how Bitcoin’s biggest advocates often characterized it, without any apparent shame—“Bitcoin is kind of a Ponzi scheme that starts with smart people,” as the prominent crypto investor Naval Ravikant had put it. But the price plummeted, in what Bloomberg later characterized as a “Stomach-Churning Ride,” a description I found more or less accurate. That month was widely considered one of the rockiest in the history of crypto, and the week after I bought in would come to be called “the worst week ever for Bitcoin investors.” Nearly $9 billion worth of positions were liquidated in twenty-four hours.

The tenor of the conversation shifted. Investors stopped referring to “super cycles” and “all-time highs” and started peppering conversations with terms like “capitulation,” “complacency shoulder,” and “liquidity trap.” Bitcoin seemed to have reached a curious juncture. Conceived as a fundamentally anarchist project—a way to bypass the state’s monopoly on money, to decentralize finance so that it didn’t require placing your trust in governments or banks—it was now increasingly mainstream, attracting the attention not only of institutional investors from major banks and hedge funds but of national and municipal governments. With this newfound success came trade-offs that seemed to threaten the ideological firmament of the whole endeavor. How could a government or bank embrace what was, at root, a tool to dismantle governments and banks? And as adoption ramped up worldwide, wouldn’t we eventually have to revisit this question of trust? Particularly for a “store of value” that could lose nearly half its value in a few days? How much risk and volatility were we willing to accept?

Which is all only to explain why, when I saw that the Bitcoin 2021 convention in Miami was approaching—billed as “the largest bitcoin event in history”—I immediately put round-trip tickets to Florida on my credit card. With the evangelists gathering for a convocation after the crash, I figured it was time I met my peers.

The moment I stepped off the plane at Miami International Airport, I was enshrouded in a kind of muggy, tropical torpor that I would wear for the next several days like a heavy coat. It was raining, as it would be intermittently throughout the weekend, the weather not at all lessening the impact of the heat. The coastal high-rises all appeared to be under construction or for rent, a haphazard skyline that affirmed the city’s reputation as a place of booms and busts, much of its prime real estate once a money-laundering front for cocaine fortunes. My hotel was across the street from a Ferrari dealership, a Burger King, and a pawnshop whose window advertised “preserved butterflies.” Driving downtown, I passed a billboard on I-95 that read tired of bitcoin’s critics? I’d later see this question again on the side of a bus stop and on the trailer of a semitruck, among other places—it was in the ether, this exasperation with Bitcoin’s critics.

There is an obvious irony to Miami’s self-conception as a city of the future: namely, that it may not have a future. It has been called, credibly, “the most vulnerable major coastal city in the world.” A headline in the New York Times two months before I arrived read miami says it can adapt to rising seas. not everyone is convinced. The week of the convention coincided with the release of an Army Corps of Engineers report recommending, among other measures, a twenty-foot-high seawall lining the coast of Biscayne Bay, one of the city’s most expensive stretches of real estate.

I have always associated the city with death. My great-grandfather was a traveling coffin salesman, and the whole of South Florida fell under his purview—there wasn’t a funeral director in Miami whom he didn’t consider a close friend. More notoriously, of course, the city has long seemed intent on denying the reality of death. A transhumanist capital of tanning beds and plastic surgery, it has more recently become a center for nootropics and life-extension startups, echoing new resident Peter Thiel’s public stance against “the ideology of the inevitability of the death of every individual.” A city where people want to live forever, and where, at least according to climate scientists, we may not be able to live for very much longer at all.

The convention’s relocation from California to Miami marked a culmination of the efforts of one Francis Xavier Suarez, the city’s forty-third mayor—the first mayor of Miami, in fact, to have been born in Miami. He often wore a blazer over a T-shirt with the question how can i help? rendered in a neon Miami Vice font. Not just your standard civil servant’s motto, it was a reference to a response he’d written the previous December to an employee of Thiel’s venture-capital firm Founders Fund, who had tweeted, “ok guys hear me out, what if we move silicon valley to miami.” His staff now calls the mayor’s reply “the tweet heard around the world.” Founders Fund had since opened an office in Miami—where at least two of its partners, Thiel and Keith Rabois, had purchased palatial homes—paving the way for numerous other tech companies and finance firms, from Spotify to Goldman Sachs. A billboard went up in San Francisco with a message from Mayor Suarez: thinking about moving to miami? dm me.

Rabois, in particular, had become an avid booster of the Magic City. “Lots of people are moving from the Bay Area and escaping jail,” he told an interviewer. And it was true: since the mayor’s tweet, there had been a major exodus from Silicon Valley, and Miami, by some metrics, was its primary beneficiary. One analysis found that between March 2020 and February 2021, nearly 35 percent more tech workers had fled the Bay Area than had the year before, and some 15 percent more had landed in Miami—more than in any other city by some margin. In terms of adjusted gross income, California had lost nearly $9 billion since Suarez took office; Florida had gained nearly $18 billion. The Miami Herald had hosted a panel on “The New Miami Economy,” and the Miami Heat’s home court had been rebranded FTX Arena, after a cryptocurrency exchange.

I had arrived in the city just in time for Whale Day, held a day before the conference proper. This event was for high rollers only, requiring a more expensive wristband that would distinguish its wearers from the less elite attendees who paid only a few hundred dollars (or the equivalent in Bitcoin) for entry. In the center of Wynwood, an aggressively gentrified neighborhood pockmarked with garish street art and designer boutiques, we were greeted at the entrance of the Mana Wynwood Convention Center by a spectacular mural of a bejeweled alligator with a gold chain in its teeth and a teapot on its back, from which exuded some sort of purple vapor that morphed into a demonic gremlin. It looked like a warning.

One of the first scheduled speakers was Michael Novogratz, a former Goldman trader (and National Wrestling Hall of Fame honoree) who had been a billionaire before Bitcoin existed, and had left the world of traditional finance to found an investment firm somewhat ominously called Galaxy Digital, which one financial journalist likened to a “crypto Berkshire Hathaway.” He was one of the many pundits who had assured us weeks before, in the press, that Bitcoin’s meteoric rise would continue unabated. On his upper right arm is a tattoo depicting Bitcoin as a rocket ship traveling to the moon.

The interior of the arena had been outfitted to simulate a colossal aquarium, the screens behind Novogratz offering an array of coral reefs and passing sea creatures. “COVID really was seminal,” he said, sitting onstage in an armchair, in response to a question about the state of the market. He talked about his time as a helicopter pilot in Alabama, where he recalled a town called Enterprise, in which stood a statue of a woman with a boll weevil in her arms. The beetle had, he explained, “destroyed all the cotton crops, so they had to plant peanuts, and peanuts brought prosperity to the region.” He thought the crypto community should erect a similar monument to the COVID-19 virus, which “in so many ways accelerated the adoption of what we’re doing.” I considered this proposal and thought of the alligator with gold in its jaws.

One of the next headliners was introduced as a “former presidential candidate.” We leaned forward in our seats in anticipation. As it turned out, this was Brock Pierce, chairman of the Bitcoin Foundation, who had run in 2020 as an independent with the endorsements of Jesse Ventura and the R&B singer Akon, who served as his campaign’s chief strategist. A former child actor best known for playing a young Emilio Estevez in The Mighty Ducks, Pierce was now a crypto billionaire and the head of a New Age commune in Puerto Rico. He reportedly slept on the floor and performed rituals involving crystals and psychedelics. Onstage he wore a patchy beard and sported a number of beaded bracelets. His talk was entitled “Why Puerto Rico?” The answer was a lack of capital gains taxes. To get there, however, required a rambling history lesson that began in the fifteenth century and included Ponce de León’s supposed search for the fountain of youth in Florida. “I’m not in pursuit of money anymore,” Pierce said proudly.

I took a break to walk the grounds with Philippe Bekhazi, the Miami-based CEO of a crypto-finance company called XBTO, the specific mission of which I didn’t really understand, though not for his lack of trying. I asked why he thought Miami had emerged as a tech hub. “Low taxes.” He shrugged. “Obviously the weather helps.” The city was more “laissez-faire” and “less complicated,” he said, than New York or California.

We were interrupted by a man named Pablo, an old friend of Philippe’s who ran one of Mexico’s largest crypto exchanges. As they started catching up, I became aware of someone eavesdropping on our conversation. He craned his neck and loudly asked Philippe, “Who are you, man?” His name was Tim Brown. He was a CBS cameraman who had come from Detroit to cover the convention. Philippe laughed nervously, explained that he ran a company, and turned back to Pablo, whom he had been asking about old friends.

“I got a great coin for you, man,” Brown interjected. They were in the right spot at the right time, he said, and the idea was guaranteed to make them rich. “You ready?” They did not seem ready. “Chupacabra coin,” he said, waving his hands for dramatic effect. “I already got the slogan, the T-shirts, everything.”

Philippe and Pablo nodded, seeming unsure whether to engage any further. “It’s all marketing,” Philippe offered encouragingly. “It’s mostly marketing.”

“Everybody’s talking about Dogecoin,” Brown went on, “but Chupacabra is urban legend. Because you know what they do?” He leaned in conspiratorially. “They kill goats,” he said. “They are goat hunters.”

The next morning, I stood with Mayor Suarez in the curtained darkness at the edge of the stage as he reviewed his notes for a speech he was to deliver to more than twelve thousand people. From the rafters above, floor-trembling EDM beats and blue and yellow lights strobed outward over the crowd we couldn’t see, but that had filled the arena well beyond its legal capacity in hopes of hearing the mayor’s opening remarks.

Suarez turned to his aides. He looked suddenly stricken. “I don’t know what to do!” he said. “What do I do? Just make it up?”

“You got this, sir,” one of them said in an obligatory way.

Onstage, the emcee had begun to address the audience, who were growing restless—you could hear them humming over the bass, which was so loud as to be physically unnerving. The emcee’s intonation was solemn: “A great man once said, ‘An idea whose time has come cannot be stopped by any army or any nation or any pandemic,’ ” he began, tweaking a campaign slogan from the libertarian former presidential candidate Ron Paul, who himself had borrowed the line from Victor Hugo. “Bitcoin is the idea whose time has come.” The audience turned raucous, a hive of droning applause.

As it happened, Ron Paul was wandering around backstage in a disheveled suit at that very moment, nervously awaiting his own slot in the morning’s itinerary. A few minutes earlier, he had been chatting with the mayor about authoritarian countries, about how they resembled the United States of America, and about the implications these resemblances might hold for the nation’s monetary policy. These were favorite topics of his: for decades Paul had been perhaps the most prominent critic of the Federal Reserve and advocate for a return to the gold standard—a true believer in the Austrian School and the concept of “sound money,” which would be safe from the confiscatory policies of the state and its central banks. Safe, that is, from depreciation or debasement. Paul had published a report titled The Case for Gold in the early Eighties, and ever since had railed against the Fed’s program of “counterfeiting U.S. currency,” by which he meant: printing more of it. And for this he had been ostracized, mocked, and dismissed as a crank by the mainstream media.

Among the Bitcoin faithful, however, Paul was now hailed as a kind of oracle. He may not have understood much about Bitcoin specifically, but he understood liberty. In his speech later that morning, he would decry the “socialists” and “sociopaths” in government who “pay people to stay at home,” and he would remind us that “money comes from the people.” We make it; it belongs to us.

In the convention’s attendees, and especially in the person of Mayor Suarez, Paul might well have recognized the cutting edge of his vision. Introduced in the wake of the 2008 financial crisis as a “purely peer-to-peer version of electronic cash” (as its founding document put it), Bitcoin had cycled through a number of defining narratives in the intervening years: an anonymous currency for the dark web; a proof-of-concept for blockchain technology (immutable, cryptographically secure ledgers of digital transactions); a safer and more private network for international remittance payments. The narrative that now reigned supreme was one that even Ron Paul could get behind: digital gold, or gold 2.0, a true store of value for the internet age.

Suarez’s hopes for Bitcoin were even grander. He saw the currency as an opportunity for a new kind of technocratic governance, a new kind of partnership between the public and private sectors. He had taken to calling Miami the “crypto capital of the world” and himself the “crypto mayor of the world.” His father, who had served three terms as mayor in the Eighties and Nineties, had considered himself a man of the people. Over the roar of the music, I turned to Suarez and remarked that his father had been known as the “pothole mayor.” It seemed a long way from this to the “crypto mayor of the world,” didn’t it? His eyes narrowed. He told me it marked “an evolution of what a mayor has to be.” Now a successful mayor has to be at the forefront of technology, a CEO of the city-as-corporation. “If you really care about the future,” he said, “you have to find a way to prepare every single citizen in your city for that future, although it can be scary for some.” He might have been referring here to his proposals that city employees be compensated in Bitcoin, and that city residents might pay their taxes with it.

The mayor cared about the future. He liked to quote Field of Dreams: “If you build it, they will come.” It was his guiding ethos. Suarez hoped to turn Miami into a kind of cyber-libertarian redoubt, like Galt’s Gulch in Atlas Shrugged, a place for techno-utopians to hide out from bureaucrats and meddlesome regulation. So far, it was working. He had built it, and they had come. And now more than twelve thousand of them were waiting to hear what he had to say.

The emcee had riled up the audience further with his diagnosis of our ailing society: “We live today in a world with lockdowns, with censorship”—here the booing became audible—“cancellation, bailouts.” The booing grew louder, the rage palpable. “Bitcoin is the solution,” he said, and again the audience cheered. Suarez was introduced as “the mayor of the mecca of freedom” and “probably the most irresponsible politician in all of America.”

He emerged into the aggressive stadium lighting to wild, enraptured applause, telling the crowd he wished that those stuck outside could be let in, because “I want everybody to hear this.” He described his lonely journey to discovering the transformational impact that Bitcoin might have on a city that fully embraced it. He’d been far ahead of his competitors. He’d even posted the original Bitcoin white paper, which described its design in the most technical of terms, on the city’s website—the first government in the United States to do so, and the second in the world after only the Republic of Estonia. “That’s the first and last time I’m ever gonna be second in the world to Estonia,” he assured us. Why was he the first in the country to get it? “We were first because in this city, we truly understand what it means to be the capital of capital,” he said. “It means to be the capital of Bitcoin.” Under a microscope, the statement took on a certain tautological aspect, but the arena was suspended in a reverential state of awe. The mayor considered his achievements with a kind of mischievous satisfaction. “Maybe I am the most irresponsible politician in America.”

Long before it acquired its pejorative sheen, “technocracy” was a relatively neutral term, and for a period in the Thirties, it was taken up as the name of a political movement led by an eccentric figure named Howard Scott. Scott proposed “governance by science,” and in a 1933 article for this magazine titled technology smashes the price system, envisioned a new currency in the form of energy certificates measured in “units of work,” which would serve as a stable substitute for the U.S. dollar. “A new system based upon a recognition and an understanding of our available energy must be devised,” he wrote. “That is the problem before the people. It can be done. Are we going to set about it before it is too late?”

The twentieth and twenty-first centuries would go on to see numerous experiments in private or alternative currencies, many of them so-called digital gold currencies like the American Liberty Dollar and e-gold. These were electronic assurances of value backed by actual gold or other precious metals, many of which were ultimately shuttered by some federal law enforcement agency or other, which tend to be unaccommodating to this sort of thing. Like Bitcoin, these attempts were inspired by a sense that the U.S. dollar had become a fraught and poorly considered fiat currency with no inherent value, and would ultimately collapse in an all-but-inevitable debt crisis or hyperinflation event. Not wanting to be carting worthless paper around in wheelbarrows like Weimar-era Germans, these investors preferred the relative security of an asset that was naturally scarce and thus naturally valuable. Unlike Bitcoin, however, these efforts still relied on a trusted third party—a central bank or account keeper. This was one of the many problems that would have to be addressed before a decentralized cryptocurrency could become truly viable. Of course, most of these problems are really only interesting (or apparent, or explicable) to people with backgrounds in cryptography or computer science, and so these were the people who solved them—developing the concepts of PGP encryption and hash functions and reusable proof of work.

It was a person or persons writing under the name Satoshi Nakamoto who finally put all the necessary pieces together and published the Bitcoin white paper in 2008. It’s interesting that we still don’t know Nakamoto’s true identity, but it’s arguably even more interesting that most Bitcoiners don’t particularly care, or they consider the question itself to be gauche. Its absent creator has become a crucial element in the coin’s cosmogony. He can’t be arrested, for one thing, but more important to the believers, he doesn’t have to be trusted—because he doesn’t exist.

Except, of course, that he does exist (or did); journalists and online sleuths have been attempting to identify him since the earliest days of Bitcoin’s prominence. Most of the strongest candidates have fallen away, one after the other, but a few of them remain in play. In the New York Times, for instance, Nathaniel Popper has written of the community’s “quiet but widely held belief that much of the most convincing evidence pointed to a reclusive American man of Hungarian descent named Nick Szabo.” Szabo had proposed one of the closest precursors to Bitcoin in the late Nineties, a decentralized virtual currency he called “bit gold.” “The problem, in a nutshell,” he wrote, years before Bitcoin was unveiled, “is that our money currently depends on trust in a third party for its value.” Szabo has more than once denied being Nakamoto. Still, when I saw that he was a headlining speaker in Miami, I thought it might be interesting to meet him. He didn’t feel the same. I wrote him an email, and after a few days he sent a reply: “Please do not try to approach me at the conference.”

Nevertheless, we were corresponding, so I went to see Szabo speak on Friday morning, a prime slot not long after the mayor and Ron Paul, who had stirred in the crowd a kind of ambient, nervy enthusiasm. Szabo’s talk lowered the temperature somewhat. It was accompanied by a slideshow filled with maps of silver flows in the seventeenth and eighteenth centuries and images of antiquated collectibles such as the sycee ingot used in imperial China. One slide featured a list labeled “Some pure fiat experiments” and included China between the eleventh and fourteenth centuries, Sweden for a few decades in the eighteenth, and “Global 1971–today.” The crowd’s response was appreciative, if muted.

Afterward, Szabo emailed me. “What did you think of my presentation?” I told him I enjoyed it, and that I hoped Ron Paul had caught some of it. I wondered if he might expand on one of the slides, which depicted an engraving of Scylla and Charybdis labeled “inflation” and “debt collapse,” respectively. These were the “terahazards” through which the central banks were vainly attempting to “steer their fiat boats.” I asked about the timeline on this, and whether the threat was as existential as he made it seem, as everyone else at the conference appeared to believe. “My father is a conservative and Ayn Rand fan,” I wrote, “but even he doesn’t actually worry about his fiat money becoming worthless in his lifetime or mine.” I asked whether he should. Szabo replied, “People without Bitcoin usually don’t worry about the risks of fiat for the same reason that fish swimming in their fishbowls don’t worry about the risks posed by such an environment. They don’t hope one day to swim in a lake or an ocean, having never observed such things. As far as they can tell the fishbowl is the world and they quickly get used to it and try to make the best of it.”

Walking through the vendor area and art gallery over the course of the conference, I began to get a better sense of life outside the fishbowl. There were portraits of Janet Yellen and Steven Mnuchin drenched in blood. One canvas depicted a Rockefeller, two Rothschilds, and George Soros sitting around a Monopoly board piled high with gold bars; behind them were chemtrails above a pyramid with an eye at its peak. An actual gold miner named Dave, wearing a flamingo-patterned shirt, put a heavy chunk of gold in my hand and told me it was worth thirteen Bitcoin. At one table, I found a brochure for a program called Bitcoin Super Learning and asked to try it. They gave me a VR headset and told me to lie back; for the next ten minutes I watched an immersive scene set in outer space, featuring New Age music and a trippy, shifting constellation of pink nebulae recalling the ending of Kubrick’s 2001. I asked them what, if anything, it had to do with Bitcoin. “We’re in talks with the Bitcoin people,” they told me. Another afternoon I was introduced to a diplomatic emissary from the Bitcoin-funded micro-nation of Liberland, somewhere between Croatia and Serbia. “It’s going very well,” he said, though starting a new country was “controversial as fuck.” Nobody actually lived there yet, for instance. The emissary himself lived in Tampa.

If the conference had a through-line, it was contempt for Elon Musk, the erratic, interstellar oligarch who had betrayed Bitcoin by first championing it—having Tesla add $1.5 billion worth to its balance sheet—and then backtracking, tweeting, “We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions,” and informing the public that Tesla would no longer accept it as a valid form of payment. This, in turn, inspired a round of articles with headlines like bitcoin’s growing energy problem and accusations that it was a “dirty currency.” Some believed Musk was deliberately manipulating Bitcoin’s price, either for personal gain or some unknown nefarious purpose. Deliberate or not, his tweets did seem to have an effect. The operative term for this was “FUD”: fear, uncertainty, and doubt. Bitcoiners were accustomed to various species of FUD (almost any criticism at all qualified, really), but coming from Musk, who had seemed to be one of them, it felt especially personal. He was denounced from the stage in seemingly every panel.

But Musk had an antithesis, a visionary doppelgänger who was fighting for the forces of good, and who Bitcoiners hoped could counter Musk’s darkness with the blinding light of truth. His name was Michael Saylor—not a household name, perhaps, but one of the world’s longest-serving CEOs of a tech company. A Washingtonian profile two decades ago dubbed him the “seven billion dollar man” and described him as the richest person in the D.C. area. “I’d like to be the Thomas Edison of intelligence,” he told the magazine. On the back of the prospectus for his company, MicroStrategy, was a quote by Arthur C. Clarke: “Any sufficiently advanced technology is indistinguishable from magic.”

A year before the conference, Saylor, who had since relocated to Miami Beach, was forced to come to terms with the fact that he was bored. He planned to retire quietly, maybe spend his twilight years traveling the world. But then the pandemic hit, he lost faith in his investment strategies, and he reexamined his priors. He read a book called The Bitcoin Standard by the obscure economist Saifedean Ammous and deemed it a “work of genius.” He gave it what is maybe the most enthusiastic blurb I have ever encountered: “The best compliment I can give this book,” he wrote, “is that I read it and I decided to buy $425m of Bitcoin.”

In The Bitcoin Standard, Ammous blamed the Fed for the modern “breakdown of the family,” and for “perhaps most damagingly, the depletion of the soil of its nutrients, leading to ever-lower levels of nutrients in food.” He compared the art of the Renaissance, Classical, and Romantic periods, all financed properly with sound money, to the decadent culture of the twenty-first century, with its “animalistic noises’’ and “immediate sensory pleasures.’’ “It was hard money that financed Bach’s Brandenburg Concertos,” he wrote, “while easy money financed Miley Cyrus’s twerks.” It was, moreover, “no coincidence that the era of central bank-controlled money was inaugurated with the first world war in human history.” Here was a theory of everything, a moral case for Bitcoin that encompassed art and war and even the nutrients in our soil. (Ammous disdains what he calls “fiat food,” claiming his diet consists of “approximately 95% red meat, 5% other meats, and approximately zero plant matter.”)

This was only the beginning for Saylor—he’d since put nearly $4 billion into Bitcoin, making MicroStrategy the first publicly traded company to hold it as a corporate asset. Saylor had become Bitcoin’s most public and steadfast advocate, appearing on CNN and CNBC, and referring to the currency as “the apex property of the human race.” Fiat money, meanwhile, was “trash,” little more than a “melting ice cube.” He was the primary exemplar of what the crypto community called a “Bitcoin maximalist,” someone who gave no quarter to any other asset, even other crypto tokens or protocols. It was Bitcoin or bust.

Saylor was scheduled to appear at the conference for a “fireside chat” with the financial pundit Max Keiser, which sounded staid and calm enough. But when Saylor walked onstage in an all-black outfit and black leather boots, an EDM drop timed to underscore his emergence, the crowd lost their minds. He looked like a star, like the hero of a spaghetti western. Keiser, wearing a white blazer and purple sunglasses, took his cues from the pandemonium and started pumping his fists and screaming maniacally with what registered as something like amphetamine psychosis but was more likely Bitcoin maximalism distilled to its essence, a yawp of rage at the fiat-addled skeptics of the world: “Yeah!” he shouted at us, doing pelvic thrusts, the music still pounding. “We’re not selling! We’re not selling! Fuck Elon!” The music finally faded and they took a seat, the crowd around me settling down if only because they were out of breath.

The most hypnotic thing about Saylor is his unwavering confidence in Bitcoin’s supremacy in every imaginable respect, something he emphasizes by never blinking as he makes ever-grander claims on its behalf. Underlying his arguments is the sense that you’d have to be, on some level, ridiculous or self-sabotaging to disagree. “Bitcoin fixes everything,” he said. It “fixes governments” and “synchronizes the world.” It returns freedom and property rights to the human race. It is hope itself—a moral imperative. Defining it, he often reverted to curious figurative language. “You can think of it as a plant life,” he said. “I put my monetary energy, my life force into it, and I let it live for the next thousand years.” The full implication of this seemed to strike him. “What’s wrong with being rich forever?” he asked.

I had requested a meeting with Saylor, and so, after he spoke, I made my way to a different building on the far side of the grounds. I was led into an elevator and sat for a while in a sterile waiting room. Two of the event’s organizers arrived, one of whom spoke angrily into a phone, then sat on a staircase cradling his head in his hands. There was apparently a bottleneck at the main entrance, and the police were warning that the situation had become hazardous. “It’s very dangerous,” one of the organizers echoed. “There are no more gates to open.”

Saylor swept through the room with his aides, who invited me to join him in a conference room, gray and seemingly long-abandoned, filled with bottled water and local real estate posters. We were air-conditioned and insulated from the madness outside. He sat at the head of the table, where he presumably felt most comfortable, and looked at me head-on. I felt briefly stunned by the hyperfocus of his gaze. On Twitter, like many Bitcoiners—from Tom Brady to Paris Hilton—he had altered his photo to make it appear as though lasers were flaring out of his eyes; it suddenly occurred to me, absurdly, that in his case it might not be an effect. “I think the next decade will be a great decade for Miami,” he said, still riding high off the energy of his talk. “It has all the hallmarks of a great city for the twenty-first century.”

I asked about the news articles suggesting Bitcoin had an energy problem—did he think this was a valid concern, particularly for a place like Miami? He waved the question away. “It’s primarily spread by people promoting alternate cryptos,” he said. Of course, in Saylor’s view, the idea that Bitcoin had actual rivals in the sector was unhinged, the opinion of an amateur. “They’re not equal, there is one that’s a million times better than all the rest,” he said. “Bitcoin is the dominant monetary asset.” He explained its significance in relation to the dollar and its imminent failure. “The currency is devaluing. The Federal Reserve is printing twenty percent more in dollars each year, which means your cash is buying twenty percent less each year.” The problem was much worse in the developing world, he pointed out, in countries with higher rates of inflation or depreciation. Try putting a hundred thousand dollars into a bank in Argentina (just try it!); the government could convert it into pesos the next day and devalue it by a factor of ten. “They did that to me once,” he said, shrugging. “I lost all my money.” Bitcoin, by contrast, was an asset that the world’s population could use to “preserve their life force” and avoid being “frozen to death.” When you really thought about it, he said, it was a human-rights issue.

This explained his passion, and that of the others at the conference—it was contempt for a world banking system designed to vampirically deprive us of what was rightfully ours, of any hope we might have to build a better life. “I take twenty percent of your money from you every year in the U.S., or I take fifty percent from you every year in Argentina, or I take ninety percent from you every year in Zimbabwe,” he said. “Those are the three choices that you have. Or what? Or I buy a bunch of land and then somebody with guns shows up and takes my land?” Bitcoiners didn’t love its volatility, but they lived with it, he said. The alternative was certain impoverishment.

As our conversation wore on, he became more and more animated, even antic, perhaps concerned I wasn’t quite getting it. I asked about the question he’d posed onstage: What was wrong with being rich forever? What had he meant by that, exactly? Now he was sure I wasn’t getting it. He seemed oddly furious. He began to proselytize sternly: “If I gave you a million dollars in pesos, in ten years it’ll buy you a cup of coffee,” he scoffed. “The whole idea is, what do I have to do in order to not lose all my money. The answer is nothing. You don’t need to trade, you don’t need to invest, you don’t need to take risks. You just need to buy Bitcoin and wait.” He fell back on his analogies, speaking faster as he went. “I have pressure in a compressed canister of air. Right? There’s energy in compressed air. Is it valuable? Sure it is. Do I have to do anything with it? No. I have electricity in a battery. What’s wrong with having a charged battery forever? What’s wrong with having infinite food forever?”

This all seemed fair enough, if not self-evidently relevant. I got the sense he wanted to grab me by the collar because I wasn’t more visibly matching his enthusiasm. “Bitcoin is a system for collecting, channeling, and storing energy in the most efficient way we’ve ever invented,” he said. “It is storing potential energy in order to stay alive.” He meant this literally. He pointed a finger at me, at eye level. “You have fat on your body? If I cut you off from food for ninety days you’d still be alive.” I glanced tentatively toward the exit. “If I take the fat away, you’ll starve to death.” I felt myself inching away, one eye on the door. “When you’re putting energy into Bitcoin, you’re storing fat,” he said. “Fat is organic energy. Bitcoin is monetary energy.”

With that, I was brushed out of the room as quickly as I’d been led in. I wandered out, dazed, into the heat of the afternoon, thinking of Howard Scott’s manifesto for the technocrats: “Everywhere energy, the source, the one and only source of life, is applied to matter,” he had written, “and behold the wonder is apparent.”

That night I found myself in the front seat of a black Hyundai rental car being steered over Biscayne Bay by a person named Jaime Rogozinski, who had woken up that morning in Mexico and didn’t seem entirely sure what he’d done with his driver’s license. Rogozinski had become infamous for founding the WallStreetBets subreddit, which had led the GameStop and AMC bull runs earlier in the year, and was in Miami to be the guest of honor at a conference after-party at the Frost Museum of Science. Taking advantage of his notoriety, Rogozinski was working on a new crypto-based venture and had sold his life rights to Brett Ratner’s production studio—at the moment, there were somewhere between five and ten movies and TV shows about WallStreetBets in various stages of production. An iPhone was affixed to the hood of his car as we drove, its camera pointed at the driver’s seat to document his every utterance. His brother was crouching in the back, trying to stay out of the shot.

On another phone, a stranger who had been pestering him for several days and claimed to be “deeply connected in the cryptocurrency space” was on speaker, pitching him on a merchandise deal. “Your brand equity is important to me,” said the stranger. “You could be just like Trump.” Rogozinski rolled his eyes. “Can you finish this conversation?” he said to his brother, passing the phone to the back seat while keeping his eyes on the road.

Despite the promise of an open bar, I wasn’t eager to go to the party, which was to be centered on an NFT auction. The term “NFT auction” itself was, in fact, enough to make me want to jump out of the car and start hitchhiking toward the airport. The easy jargon and self-satisfaction of most of the crypto-evangelists I’d met had begun to leave me cold and worn out. Put another way, my curiosity had been satisfied. Truthfully, I regretted ever investing any money in this stuff, which appeared increasingly cynical and nebulous. All the imagination and resources being spent on glossy new financial market infrastructure—it was profoundly discouraging. Maybe in a few years we’d all be living in the metaverse, trading social tokens (Chupacabra coin, perhaps), but I figured I’d rather opt out for now. Contra The Bitcoin Standard, it seemed far more like a symptom of decadence than a cure for it.

I wanted to talk to Rogozinski about the notion of extreme volatility, as he had witnessed its full, unbridled potential up close. In an interview with the Wall Street Journal, he’d compared watching the GameStop pump to both a horror film and a train wreck. I asked what he meant. “I think it’s really scary, because these guys are playing with their own lives but they’re also playing with a system where you don’t know at which point it can break.” We veered a little too sharply off the MacArthur Causeway—we were hours late to the party—back downtown. “There’s always been that casino quality, but there’s nothing wrong with a casino,” he said. So what made this era different? “It’s globalized,” he said eventually. “Barriers to entry have been breached. Complexity has been eliminated.” We parked and walked up a staircase to the museum’s elevator. Hoping to live vicariously through someone who rode out the bull market better than I did, I asked if he’d at least made a killing on the short squeeze. “I did not make a killing on GameStop,” he admitted, puffing on an e-cigarette. “I don’t trade stocks.” Puzzled, I asked what he’d recommend to someone getting into the market for the first time. “Get into index funds.” He shrugged and then headed into the party.

The auction was even grimmer than I’d imagined—the dregs of humorless meme culture sold for ridiculous sums to a crowd of indeterminate age and milieu. Most of the NFTs were images incorporating Pepe the Frog, a transgression that itself seemed passé and somehow lonesome. I ordered a whiskey on the rocks and gravitated toward a shallow pool of stingrays, running my hand over the surface of the water. After a while, I ducked out of the party and took the elevator back down to the museum’s first floor, which was closed. I tried a door and found it unlocked. The lights were off, but I could see well enough to tell that the room was dedicated to the pterosaurs, “the largest flying animals that ever lived.” I read the exhibit copy by the light of my phone:

Around 150 million years ago, a young pterosaur died, and its body sank to the bottom of a lagoon. Before the corpse could decay, layers of sediment settled on top, pressing the pterosaur flat, like a flower pressed between pages of a book. Minerals replaced the bones, so the skeleton turned to stone. For eons, this pterosaur lay hidden in a bed of limestone near Solnhofen, Germany—until a worker cut the stone from a quarry and cracked the layers apart, revealing the skeleton, along with a ghostly impression in the facing rock.

What’s wrong with being rich forever? I toasted the fossil on the wall, left my drink on a bench, and began the long walk back to my hotel.