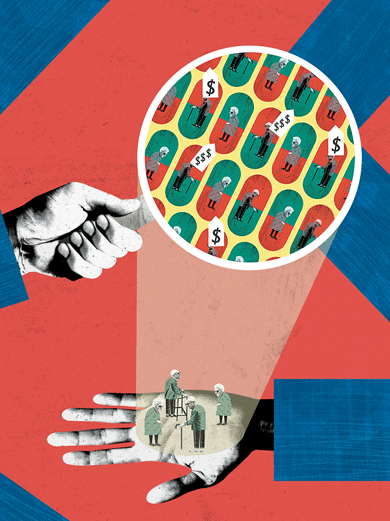

On a brilliantly sunny afternoon last October, twenty-eight New Yorkers—some clutching walkers, others in wheelchairs—crammed into a tiny space at the back of Manhattan’s East Side Cafe. While waiters set down blueberry coffee cake, grape jelly, coffee, and orange juice, Maxine Davis, a Medicare account representative from Empire BlueCross BlueShield, raced through the first several pages of the company’s sales booklet. She was promoting MediBlue Plus (HMO), a private plan that Empire offers as an alternative to traditional Medicare. “The maximum amount you pay out of pocket for major medical expenses is sixty-seven hundred dollars. This makes it a predictable health-care cost. We never make you pay more,” Davis promised.

One senior asked, What if someone had cancer?—a diagnosis whose costs could quickly escalate. The patient’s share of such costs was “written in black and white,” Davis answered, vaguely referring him to page 6 of the booklet while noting that “a lot of people would be excited about a twenty-dollar copay for chiropractors.” Page 6 didn’t actually address his question, but pages 7 and 12 did. There he could have read that beneficiaries were on the hook for 20 percent of the cost for radiation treatment and 20 percent of the cost for chemotherapy, up to the $6,700.

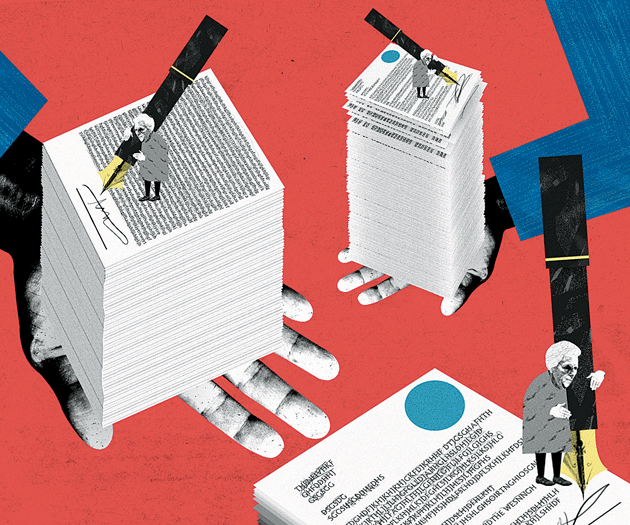

That crucial point probably went over the heads of most attendees at the coffee shop. Lured to the sales event with a mailing that promised no monthly premiums for their plan coverage, they came seeking a way to stretch their budgets; “free” health insurance is almost as irresistible as free food. One man wanted to know if the next year’s premium would be free as well. Davis simply said, “For 2016 there’s a zero-premium plan.” Clearly eager to reiterate that magic number, she added, “All your preventive care is covered at zero dollars.” She went on to pitch as special perks such services as colonoscopies and mammograms, which the federal government makes available for free to all Medicare beneficiaries.

Davis didn’t dwell on the fine print. And she knew all the right words to get the seniors to sign up. “I find it really wonderful there’s a nurse help line for you twenty-four hours a day,” she said. She mentioned “one of Empire’s most prized benefits,” the SilverSneakers program, which granted free gym memberships to enrollees. Empire “was innovative.” As proof, Davis said, “You can see your doctor online and call customer service.” When a woman complained that it was hard to reach Empire on the phone, Davis was reassuring. “You are important to me. I carry my cell whenever I go shopping.”

When Lyndon Johnson signed Medicare into law fifty-one years ago, on July 30, 1965, he made a number of ambitious promises:

No longer will older Americans be denied the healing miracle of modern medicine. No longer will illness crush and destroy the savings that they have so carefully put away over a lifetime. . . . No longer will young families see their own incomes and their own hopes eaten away simply because they are carrying out their deep moral obligations to their parents, and to their uncles, and to their aunts.

Medicare, the president told the crowd at the Harry S. Truman Library in Independence, Missouri, was another important part of the social-insurance structure designed by Franklin Roosevelt thirty years earlier—a structure, FDR said at the time, that was “by no means complete.”

After LBJ ended his remarks, New York Times Washington correspondent Max Frankel approached him. “My mother thanks you,” Frankel said. “No,” the president replied. “It’s you who should be thanking me.” Johnson intended for Medicare, crafted according to the same principles as Social Security, to be a safety net not only for Frankel’s mother but also for all Americans into the future. The idea, then as now, was to provide health insurance to millions of older, sicker people at a cost more reasonable than what the private market could or would provide.

After LBJ ended his remarks, New York Times Washington correspondent Max Frankel approached him. “My mother thanks you,” Frankel said. “No,” the president replied. “It’s you who should be thanking me.” Johnson intended for Medicare, crafted according to the same principles as Social Security, to be a safety net not only for Frankel’s mother but also for all Americans into the future. The idea, then as now, was to provide health insurance to millions of older, sicker people at a cost more reasonable than what the private market could or would provide.

For the time being, the basics of the program Lyndon Johnson called for are still in place. Everyone who pays into the system during their working years—contributing 1.45 percent of each paycheck, which is then matched by their employer—earns the right to common benefits at age sixty-five. Those contributions cover a substantial amount of hospital care, home care, and skilled nursing care. There is a deductible required for hospital care, which is adjusted for inflation each year, as well as coinsurance, the patient’s share of the cost.1 This section of the program is labeled Part A.

Under a separate plan, called Part B, beneficiaries are covered for medical and surgical fees incurred in or out of the hospital, lab tests, medical equipment, and outpatient care. Part B does in fact require additional contributions from patients, who pay a monthly premium that is adjusted annually. The government, through general tax revenues, funds the rest.2

A key fact: Medicare was never meant to cover all of a beneficiary’s medical expenses. To fill this gap in coverage, a separate industry sprang up to sell supplemental insurance, known as Medigap policies. Standardized by the government in 1991, these policies are now purchased by millions of seniors, and many companies offer similar supplemental coverage to former employees.

Soon after it was signed into law, Medicare gained favor with the general public. “Polls repeatedly show that Medicare is one of the most popular domestic programs,” says Robert Blendon, the director of the Harvard Opinion Research Program. “It’s seen as highly important to people’s lives.”

Medicare’s popularity, however, comes with almost no understanding of what the program is and how it works. “I don’t want government-run health care,” a woman wrote to President Obama in 2009. “I don’t want socialized medicine. And don’t touch my Medicare!” That confusion has made it hard to defend Medicare against Washington’s slash-and-burn campaigns aimed at killing the country’s social programs. Under discussion now in the halls of Congress and in the opinion columns of the news media is a plan to transform Medicare into a more privatized system. Not only would this break apart the social compact and render Johnson’s promises a distant memory—it would also pass more of the program’s expenses on to the elderly and disabled.

Johnson’s social compact, however, began to erode as far back as the 1970s, when oil shocks, a stagnant economy, and inflation came to dominate the national agenda. The liberals’ goal of rounding out LBJ’s vision by expanding Medicare to all Americans disappeared. Meanwhile, the cost of health care itself began to skyrocket. Between 1970 and 1985, the cost of such care as a percentage of GDP rose by nearly fifty percent. Expensive new technology such as imaging machines and lithotripters to pulverize kidney stones flooded the market. Hospitals and physicians rushed to buy these new machines, and then used them freely to cover the cost of their investments, driving up prices even faster. And all along, Medicare kept paying the bills.

This gave an opening to Medicare’s enemies. “If you couldn’t attack the program directly, you attacked it as unaffordable and uncontrollable,” says Yale professor emeritus Theodore Marmor, whose 1970 book The Politics of Medicare describes the contentious politics and compromises that led to the creation of the program.

By the 1990s those attacks were being taken seriously in Washington, and policy discourse around Medicare was soon reframed. Now the virtues of the marketplace—competition, individual choice—were touted over the virtues of social insurance, especially as a means to contain costs. Soon it was clear that Medicare was no longer untouchable. In 1995, John Kasich, then chairman of the House Budget Committee and now governor of Ohio, proposed slicing $270 billion from Medicare’s budget to pay for a $90 billion increase in defense spending. It was part of a “bold plan,” Kasich announced, to “downsize government.”

His boss at the time, House Speaker Newt Gingrich, had his own vision for Medicare. If private alternatives were available, he predicted, people would voluntarily switch. Medicare would “wither on the vine.” Persuaded by Gingrich, along with other Republicans and many Democrats, the government began to make that happen, using a combination of salami tactics and stealth.

The right-wing Heritage Foundation provided the intellectual blueprint. It proposed transforming Medicare into a system like the Federal Employees Health Benefits Program, whose beneficiaries choose coverage from a menu of government-subsidized private plans. The idea quickly gained respectability, with the help of favorable and unquestioning media coverage and an influential paper written in 1995 by Henry Aaron and Robert Reischauer, Democratic economists from the Brookings Institution. They called for a system of “premium support”—a sum of money the government would give beneficiaries to buy their own insurance in the private market. (Some critics called this a voucher system.) If the government sum was too small, beneficiaries would have to pay the difference themselves.

Aaron himself later changed his mind about such arrangements. “What we were defending in the article was a different proposal than the one that has emerged in the last ten years,” he told me. “I came to the conclusion it is not workable now.”

Aaron’s change of heart didn’t stop the march toward privatization, though. The idea of Medicare transforming itself from social insurance into a private, market-based system had caught on. In 1997, Congress continued to push privatization with a new program called Medicare + Choice—a largely managed-care model that beneficiaries could choose as an alternative to traditional Medicare. Crucially, private insurers, not the government, would provide the benefits.

Medicare + Choice proved a costly and fateful step. Insurers soon demanded more money from the government in order to sell private plans, especially in smaller, rural markets where they were reluctant to go. It came down to “how much money on the table was necessary,” says a former high-level Democratic staffer on Capitol Hill, who agreed to talk to me only on the condition of anonymity. “We were bribing them.”

In the end it took billions to get insurers on board, and to keep them there. By 2009, Congress was doling out 12.4 percent more to private insurers than it would have spent to provide the same benefits via traditional Medicare. “For most of the program’s history, Congress has thrown money into the pot to assure a robust expansion of private plans and provide extra benefits for beneficiaries signing up,” says Robert Berenson, an institute fellow at the Urban Institute.

In 2003, as part of the Medicare Modernization Act, Congress authorized private companies to offer yet another type of plan, called Medicare Advantage—which is what Maxine Davis was selling at the East Side Cafe. Because of generous government payments, many MA plans require no premiums (although seniors still must pay their Part B premiums to the government). Often, they will also offer extra benefits that are not part of the standard Medicare benefit package, such as eyeglasses, hearing and dental exams, and gym memberships like the SilverSneakers program Maxine Davis mentioned. Many come with high out-of-pocket maximums (for instance, Empire’s $6,700), after which the insurer will pay 100 percent of the cost of medical care—to in-network providers only.3

But Congress was not yet done tilting the scales toward private insurers. In the same law, it introduced the Part D drug benefit. This provision allowed only commercial insurers to offer drug coverage. Both the government and Medigap plans, which had previously offered such coverage, were now forbidden to do so. Even people still covered by traditional Medicare now had to buy separate drug plans from private carriers.

The Medicare Modernization Act poked yet another hole in Lyndon Johnson’s fraying compact. It called for wealthier beneficiaries—people with incomes above $85,000 if single or $170,000 if married—to pay higher premiums for Part B benefits. The provision moved through Congress with “unexpected support from some Democrats,” the New York Times reported. As the law neared final approval, though, the Times noted that AARP, the UAW, and liberal Democrats, including Senator Edward Kennedy, viewed some of its proposals as a “dangerous first step in turning Medicare from a universal social insurance program into a welfare program.”

In a sense, the conservative assault on Medicare is two-pronged. On the one hand, there is a drive to privatize. On the other, critics hope to rebrand Medicare as a variety of welfare. The former Hill staffer says that the Republicans have “been on a very consistent march for decades now. They basically want to get rid of the entitlement and want everything means-tested.” Means-testing—that is, basing eligibility for benefits on whether a person has the means to do without that help—saves billions for the government. But it would also make Medicare into the equivalent of food stamps or Medicaid. And that, of course, is the objective.

So far, privatization remains the more politically correct solution for Medicare’s financial shortfalls. These are real, at least potentially. In large part, they have been caused by the lack of serious cost controls, and exacerbated by the influx of millions of baby boomers needing medical services. Even the government’s attempts at cost control introduced during the Reagan era failed to permanently curb medical inflation. Indeed, containing the prices charged by the doctors, hospitals, drug makers, nursing homes, and home-care agencies that rely on the Washington gravy train has been an almost impossible task. The 2003 prescription-drug law, for example, prohibits Medicare from negotiating the prices it pays for drugs. “There are obstacles statutorily and politically,” says former Medicare administrator Don Berwick. “We can’t negotiate for purchasing, in one of the largest insurance systems in the world. The moneyed interests are calling the shots.”

Many of those moneyed interests sell health-care technology, which has long been a major cause of exploding costs. Richard Foster, who was Medicare’s chief actuary from 1994 to 2013, describes the situation: “As long as there’s an automatic market for new technology, even if it’s not any more effective, cost growth will keep going up.” In fact, Medicare has historically not considered cost effectiveness when deciding whether to cover new drugs and technologies. Two years ago, a study published in JAMA Internal Medicine revealed that Medicare spent $8.5 billion for low-value services—CT scans for uncomplicated sinus infections, prostate-cancer screenings for men over seventy-five.

Even when Medicare has limited the use of technologies, health providers sometimes use them anyway. In the past year, for example, the Justice Department has announced settlements with 508 hospitals that had used implantable cardioverter defibrillators in some 10,000 patients. The DOJ fined the hospitals—including some of the biggest names in the business, such as the Cleveland Clinic and NewYork-Presbyterian—for violating Medicare’s “national coverage determination” for I.C.D.’s. According to Sanket Dhruva, a cardiologist and researcher at Yale, these patients may also have been subjected to unnecessary harm. So why were hospitals using the devices? Because they were, needless to say, hugely profitable—between 2010 and 2015, when news of the investigation caused I.C.D. use to drop 28 percent, Medicare saved about $2 billion.4

The pharmaceutical companies are equally adept at gaming the system. Over the past few months, cancer doctors and arthritis specialists have waged a very public fight to scare patients into believing they aren’t going to get expensive Part B drugs. Medicare pays 80 percent of the cost of these drugs, which are typically administered in physicians’ offices. But the current system, which Medicare wants to change, pays doctors a percentage-based profit, which encourages them to use more expensive drugs. “Doctors are carrying water for the pharmaceutical corporations because their interests are aligned,” says Peter Bach, the director of the Center for Health Policy and Outcomes at Memorial Sloan Kettering, in New York City. “I know of no other system where raising the price of your product makes it more attractive.” Medicare recently reported that the total cost of prescription drugs for its 38 million beneficiaries rose 17 percent in 2014, even though the number of claims rose only 3 percent.

Insurers get their way, too, when it comes to protecting Medicare Advantage plans. In March, the government quietly changed the regulations for its widely touted MA star-rating system so that Cigna, one of the country’s largest insurers, could continue receiving the bonuses that are awarded for higher ratings. Two months earlier, as it happens, Medicare had sent the company a strong letter of sanction citing “serious violations” and barring the carrier from enrolling new members. The letter said that beneficiaries had experienced inappropriate delays and denials of medical services and medications, received inaccurate and incomplete information, and been denied timely resolution of requests for coverage—infractions that hardly suggest a plan meriting four or five stars. Cigna was in danger of losing as much as $350 million in bonuses. Then came the rule change—and two days later, a 2 percent surge in the value of Cigna stock.

According to the Center for Public Integrity, MA sellers collected nearly $70 billion between 2008 and 2013 by overstating patients’ health risks. In May, the General Accountability Office issued a report showing that Medicare often failed to audit private health plans and recoup overpayments. The GAO called for “fundamental improvements” in Medicare’s operations.

Given the monumental sums Medicare has been paying out, it’s hardly surprising that for years the annual report issued by the program’s trustees has argued that it needs more revenue. This year’s report, released in June, warns that although Medicare’s costs are low by historical standards, there is substantial uncertainty regarding the adequacy of future Medicare payment rates under current law. The report also notes that the depletion date for the hospital trust fund is now 2028.

Contrary to the claims of Medicare’s opponents, though, it is not going broke or running out of money. Actually, in 2014 Medicare spent $1,200 less per person than in 2010, largely because of cuts mandated by the Affordable Care Act. And even the trustees conceded that in 2028 Medicare would still be able to pay 87 percent of the benefits it now provides. Nevertheless, concerns about long-term financing remain, and containing costs is crucial.

According to Richard Foster, Medicare’s former chief actuary, Part D drug expenditures grew by more than 12 percent in 2014, and another 15 percent in 2015. Costs for medical services will go up, too. Foster believes that payment increases for doctors and hospitals will not be adequate as time goes on, and may reach a point where providers become unwilling to treat patients. In this year’s trustees’ report, the current chief actuary, Paul Spitalnic, made a similar argument:

Absent an unprecedented change in health-care delivery systems and payment mechanisms, the prices paid by Medicare for most health services will fall increasingly short of the cost of providing such services.

Medicare is placing its bet for cost control on new ways to pay doctors, penalties for bad care, rewards for good care, and more coordinated care. Whether these practices will work and how much they will slow down the growth in costs is unknown, and most Medicare experts on both the left and the right believe that new revenue will be needed. Along with her colleagues at the American Institutes for Research, former Medicare trustee Marilyn Moon (who remains skeptical of privatization) believes that critics often overstate the program’s financial challenges. At the same time, they admit such challenges are real: “We cannot objectively argue that there is no problem or that no changes should be made to the program to try to reduce its costs over time.”

The big question is who should bear the burden of necessary revenue increases—taxpayers or Medicare beneficiaries. So far the answer from the government, many economists, and conservative advocacy groups is, unequivocally, the beneficiaries. Moon and her colleagues note that the “potential depletion of the trust fund in the future is taken as ‘proof’ that benefits must be reduced.” But in a subsequent interview, she warns that as more of the cost burden is shifted to the beneficiaries, “the likely reaction will be that benefits become so small Medicare won’t remain viable. It would destroy the program.”

It’s ironic that when it comes to one of the government’s most popular public programs, there’s no talk of raising taxes—an option polls show much of the public is willing to support. The failure of policymakers to consider revenue increases reflects the success of the right’s thirty-year crusade to change the conversation. “Those of us at the Heritage Foundation and allied public-policy institutions like the American Enterprise Institute have effectively defined the terms of the debate on Medicare reform,” says Robert Moffit, a senior fellow at Heritage. The Democrats, he adds, “are debating our proposals. We’re not debating theirs.” Former Iowa senator Tom Harkin tells me that his fellow Democrats were poor strategists, always finding themselves in rearguard actions trying to block provisions they didn’t like. “The Democrats were talking a good game for the immediacy, not the long term. It’s like checkers,” he says. “They knew how to block the next move, but were not seeing the row lined up at the back of the board.”

Whether out of capitulation or conviction, Democrats have teamed up with the G.O.P. to open the government’s coffers to sellers of MA plans. In 2013, according to Mark Farrah Associates, a publisher of business information and analytics, publicly traded insurance companies like Humana, WellCare Health Plans, and UnitedHealthcare depended on government largesse for at least 40 percent of their total revenue. In the company’s February 2016 report to Wall Street analysts, Aetna CEO Mark Bertolini gloated, “The fourth quarter capped off an outstanding year for our government business, which continues to be a key growth engine for Aetna.”

Insurers owe the extraordinary profitability of MA plans in no small measure to the Coalition for Medicare Choices, a phony consumer group created by their trade association, America’s Health Insurance Plans, in 1999. The Coalition represents a gentle conspiracy between seniors who get extra benefits and the MA plans that use those seniors to advocate for the higher reimbursements that make eyeglasses and gym memberships possible. Every year, when Medicare announces proposed rates for the following year, AHIP mobilizes its army, flying its soldiers to Washington to testify before friendly congressional committees about the need for more money to prevent benefit cuts. It also encourages seniors to send emails, make phone calls, and appear at town-hall meetings.

Last spring, AHIP’s seven-figure advertising blitz opened a new phase of its Seniors Are Watching campaign, which began in 2014, with a press release proclaiming that Coalition members “are paying attention to policy decisions that impact their coverage—and they vote.” The AHIP website warns, “When Seniors Act, Congress Listens: Bertha Shinn is watching. Lori Chen is watching. Sen. Chuck Schumer is listening.”

New York’s senior senator did listen. Schumer and Senator Mike Crapo, a Republican from Idaho, persuaded fifty-nine of their colleagues to send letters urging Medicare not to cut payments to MA plans. They were joined by more than 360 House members, who shared their contention that cuts “have the potential to stifle innovation and impede beneficiary access to high quality health care.” (When I called Schumer’s office to talk to him about his support for MA plans and the government’s role in eroding traditional Medicare, I got no response.)

This sort of epistolary campaign seems to be working. For the past three years, Medicare has given MA plans increases after initially announcing payment cuts. This year, Medicare proposed an increase of about 1 percent after adjustments. A six-week lobbying blitz succeeded in tripling the increase.5

It’s hard for legitimate consumer organizations to fight against this well-financed message machine and the confusion it creates for seniors. Pamela Tainter-Causey, communications director for the National Committee to Protect Social Security and Medicare, decries the use of such tactics: “What they tell seniors is that Congress is going to cut its spending. They tell them it’s a cut to their benefits, when this is really about reimbursement cuts for the plans. What they don’t say is Medicare is trying to rein in runaway health-care costs. It’s not about Congress trying to cut seniors’ benefits, but that’s how they portray it.”

The 2016 election could well decide the future of Medicare, a topic that is bubbling beneath the surface, waiting to erupt into a full-blown policy debate whose stakes the public and the media have yet to comprehend. In September, a poll from the Kaiser Family Foundation revealed that Medicare (along with access to and affordability of health care) was the top health-related issue that registered voters wanted candidates to discuss. So far, though, except for Bernie Sanders’s fling with Medicare for All, the program has not been a focus during the campaign. It may be the program’s very popularity that has prevented candidates from talking about it. A few years ago, a candid if rhetorically challenged Donald Trump told a group of Republicans, “If you think you are going to change very substantially for the worse Medicare, Medicaid, and Social Security in any substantial way, and at the same time you think you’re going to win elections, it just really is not going to happen.” (As recently as September, Trump suggested that he would not change Medicare benefits—a position totally at odds with his own party’s platform.)

A fact sheet from Hillary Clinton calls her “a champion for America’s seniors,” noting that she will “defend Medicare” and “fight against Republican threats to end Medicare as we know it by privatizing or ‘phasing out’ the program.” As for containing the program’s costs, Clinton will “continue to reward quality and improve value in Medicare by building on delivery-system reforms that began as initiatives and pilot projects under the Affordable Care Act.”

No tough stuff here, and lots of hazy language that would allow a President Clinton to do almost anything in the legislative give-and-take. The devil is in the details, and she has yet to commit to any of those.

Her promises may be vague, but it is much clearer who has her ear. According to the Center for Responsive Politics, Clinton has received more than $10 million from the drug industry this election cycle. Clinton has said she favors Medicare price negotiations with the drug industry, but a careful reading of her website reveals that she would use the government’s negotiating muscle only as a “backstop” when competition alone isn’t sufficient to drive prices down. Perhaps pandering to Bernie Sanders’s supporters, however, Clinton has floated the idea of allowing people aged fifty or fifty-five to buy into Medicare, a proposal that surfaces from time to time.

Of course, what candidates say on the campaign trail doesn’t always reflect what they will do once they reach the Oval Office. Barack Obama repeatedly vowed to cut excess payments to Medicare Advantage plans. As of this date, the government still pays MA plans about 2 percent more on average than it costs to provide the same benefits in traditional Medicare. For that matter, as a senator in 2008, Obama voted against a Republican amendment that would have required wealthier seniors to pay more for their drug benefits. (Senator Hillary Clinton also voted against it.) But the president’s Affordable Care Act called for the same income-related premiums, and his budgets from fiscal year 2013 on have also embraced them.

This year, the political action on Medicare has taken place out of public view, in congressional offices and committee rooms. There, staffers led by House Ways and Means chairman Kevin Brady, a Texas Republican, have been crafting legislation that would begin to convert Medicare from social insurance to a premium-support or voucher arrangement. In June, House Republicans declared that they were taking a fresh look at the program, “redesigning it so that it fits the seniors’ needs more closely, offering new options so seniors can take that backpack into their retirement years.” This language can mean anything, including change so radical as to destroy Medicare once and for all.

Will Brady’s proposed premium support be large enough to keep pace with health-care inflation? Will the personalized option he envisions leave beneficiaries, about half of whom live on less than $24,000 a year, holding the bag for thousands of dollars in out-of-pocket costs? Will Medigap policies disappear altogether, forcing the millions of Americans now relying on them into Medicare Advantage plans?

In other words, the details will matter a lot. Currently, MA plans must offer the same basic benefits as traditional Medicare—but as the Kaiser Family Foundation has noted, that may no longer be the case with a premium-support system. Some proposals are aimed at giving sellers of MA plans the freedom to change benefits, premiums, and copays at will, further destroying the idea of social insurance. It’s possible these proposals would attract younger seniors, who are likely to be healthier, leaving only the older, sicker beneficiaries in traditional Medicare. If this happens, Medicare’s risk pool would be destabilized, leading to ever-higher premiums for those who remain and, eventually, to what the insurance industry calls a death spiral.

Brady and House Speaker Paul Ryan may move to revamp Medicare as soon as next year. In December 2014, Ryan told Politico, “The best days are yet ahead on comprehensive Medicare reform and premium support. . . . It’s an idea that has been normalized.” One thing is clear: the pitch for “saving” Medicare will exploit seniors’ fears of losing their benefits and obscure what the proposed changes really mean.

Gail Wilensky, the head of Medicare under the first George Bush and now a senior fellow at Project Hope, favors premium support. She tells me that the slowdown in Medicare costs may not last. It’s already too late, she says, to make changes and allow all of today’s seniors to stay in traditional Medicare with their Medigap policies—something that was always promised in earlier discussions of premium support. “Not everyone coming on in the next decade will get a pass,” she says. If Wilensky is right, people now in their fifties and early sixties may have little choice but to accept a privatized version of Medicare, with a narrow network of providers and possibly less comprehensive coverage and more out-of-pocket costs.

Although it’s clear that Medicare will need an infusion of new revenue in the coming years, beneficiaries should not be the piggy bank that saves the program. If LBJ’s vision is to be maintained for the community now and in the future, the community as a whole—taxpayers—must protect it. So far the acceptable solution is to make beneficiaries bear the escalating cost of medical care and thereby shift the burden away from government. But this is the swiftest route toward shredding the social compact that Johnson enunciated back in 1965. The burden of cost containment must fall on providers and others in the health-care industry, not on beneficiaries, who are least able to handle the increasing costs.

There are still those who regard Medicare as the solution, not the problem. “Instead of voucherizing Medicare, we should be expanding it,” says former administrator Don Berwick. Moving to Medicare for all, which Berwick would like to see, will be difficult, given the politics of interest groups and the power of Medicare providers, who are doing just fine under the current system. It may be that the best we can do now is to somehow reconcile traditional Medicare and Medigap policies with MA plans. To do this, traditional Medicare would have to be made more attractive, with a reasonable spending cap that would benefit the millions of beneficiaries who can’t afford Medigap premiums or the out-of-pocket spending required by Medicare Advantage plans.

Yet the drive toward privatization goes on. Who has the most to gain from it? Clearly, insurers would benefit mightily from all the new business that would come their way. Privatization would also appeal to those who favor a smaller federal budget as well as smaller government.

And what of beneficiaries? For them, the answer is mixed. Seniors with enough financial resources would be able to buy whatever private insurance they want to cover Medicare’s gaps, but those with modest means would likely struggle to maintain access to providers they like and trust, especially if policies offered in the private market have narrow networks—a likely possibility. (A recent Kaiser study of twenty counties found that, on average, MA plans included only about half of the hospitals, while 40 percent did not include a National Cancer Institute–designated cancer center.)

Seniors who buy MA plans because of the extra benefits may also lose in the long run. Very little is really known about how these plans care for people who become seriously ill or need specialty treatment. Although seniors have the opportunity once each year to return to traditional Medicare, they cannot necessarily then buy a Medigap plan to supplement their coverage, since the rules governing such purchases vary from state to state.

A real marketplace assumes that buyers have good information. But after writing about this program for twenty-eight years, I’ve concluded that one of Medicare’s biggest deficiencies is the lack of information we have about how it works, how to navigate it, and how to make good choices. For instance, it’s unlikely that those currently considering MA plans know that in June, the Senate Appropriations Committee voted to eliminate $52 million in funding for the State Health Insurance Assistance Program, which offers unbiased counseling to people coming into Medicare, those already in the program, and disabled people. The SHIPs, located in every state, served more than 7 million people last year. According to Roy Blunt, a Republican senator from Missouri, however, they were among the “unnecessary federal programs”—and so their funding was axed.

Without SHIPs, more would-be beneficiaries will be easy targets for sellers of MA plans. The legitimate consumer organizations that could help provide vital information often have chronic funding shortfalls. Giant AARP has competing business interests. Its partner, UnitedHealthcare, sells a lot of MA plans, as well as Medigap plans. In the current marketplace, there’s no standardization of benefits so that seniors can tell what their policies really cover, as there is for Medigap plans. In many parts of the country, especially urban areas, there are simply too many choices—as many as thirty or more. How are beneficiaries supposed to navigate an annual shopping process that, as Marilyn Moon puts it, is “hopelessly complex”? That leaves the sellers of MA plans to guide the shopping decision. Dan Adcock, the director of government relations for the National Committee to Preserve Social Security and Medicare, says, “Some in the advocacy community thought the experiment with private plans would die under its own weight.” But they were wrong, he admits, and carriers had little difficulty in selling their products. “Insurers knew how to exploit seniors’ precarious financial conditions with free food, free gym memberships, and sales pitches touting no premium.”

He’s right. Back at the East Side Cafe, as the sales pitch wound down, I approached a man who was struggling to find a pen. I asked if he was signing up, hoping to engage him in conversation. He wasn’t interested in talking. He said he wanted to finish the application before the coffee ran out.