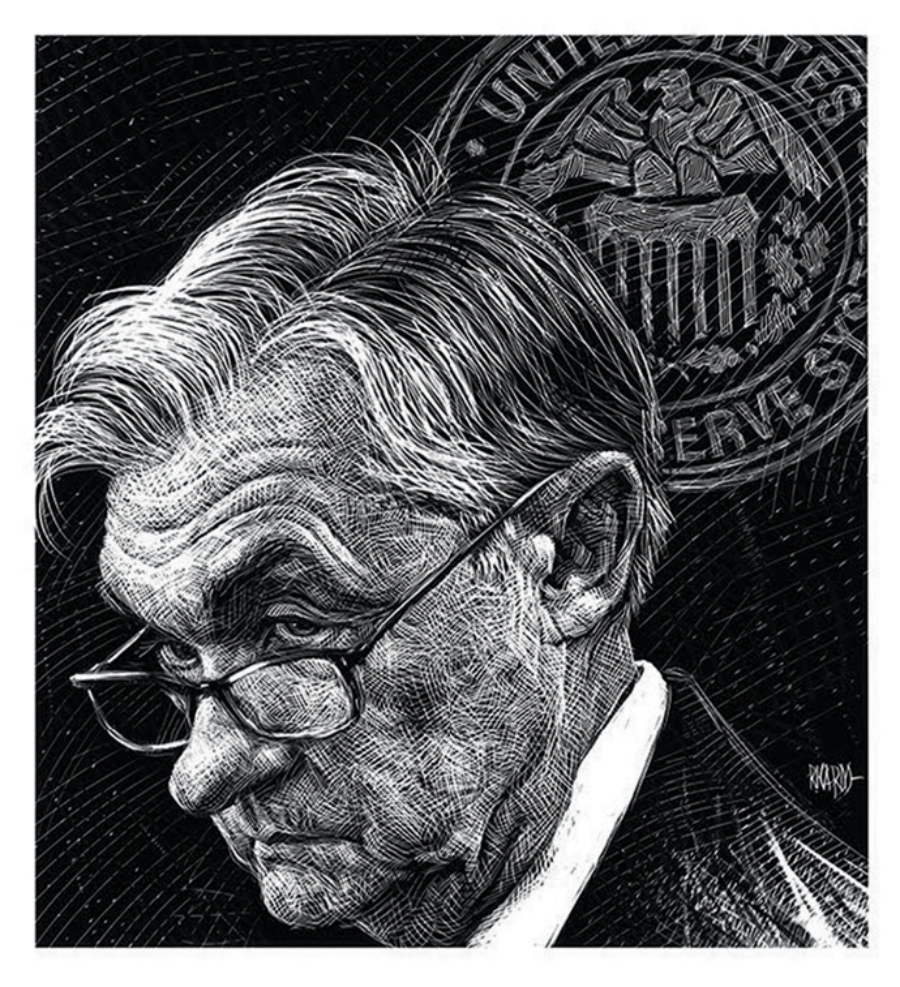

Illustration by Ricardo Martínez

Donald Trump likes low interest rates, and he doesn’t hesitate to let the world—or, more to the point, the Federal Reserve chair, Jerome Powell—know about it. “The Fed is raising rates too fast,” Trump told Fox Business Network shortly before the 2018 midterm elections. “The only problem our economy has is the Fed,” he tweeted soon after. Powell, in Trump’s analysis, is “clueless” and suffers from a “horrendous lack of vision.” On Twitter and elsewhere, Trump has publicly flirted with demoting or firing the Fed chair if he doesn’t get the message, and he has privately suggested that Powell…